Rewriting The Nation’s Poor Fiscal Responsibility Index

-

January 8, 2016

- Posted by: Center for Social Justice

Rewriting the nation’s poor fiscal responsibility index

By Chijioke Nelson and Lucky Orioha on January 6, 2016 2:46 am

Fiscal Responsibility CommissionSound fiscal policy and responsibility must be inseparable if any nation would have meaningful growth and development outcomes. In fact, their appropriate mix can have important long-run effects on the health of the economy through its desired impact on not only national savings, but on the growth of productivity. Perhaps, it wouldn’t be a hasty conclusion at this stage to say that Nigeria lacks this mix.

Fiscally responsible behaviour service delivery rubs off on productivity level, which is the principal source of improvement in economic well-being. Maintaining a rapid rate of growth in productivity is particularly important now given budgetary pressures associated with the continuous decrease in international oil prices and consequent pressure on the country’s external reserves, rise in external and domestic debts and naira value.

Indeed, the adoption of fiscal responsibility principles by different Ministries, Department and Agencies (MDAs) at every level of governance in Nigeria will have a positive effect on the rising unemployment, improve social and economic infrastructure, reduce over dependence on oil, as well as reposition the country for food sufficiency and food security. So far, the country seemed to have been on the wrong path.

Fiscal responsibility, according to wiseGEEK.com is an economic concept that can have a couple of definitions depending on the circumstances, though it mostly involves strategies for managing debt and adopting practices of so-called “smart” spending. To some, it is just a matter of cutting debt and others say it’s about completely eliminating debt while also planning for the future. But fiscal responsibility is beyond balancing the budget and includes elements of transparency and accountability, evidence led budgeting and guarantees of rules-led fiscal system.

Ads by Buzzeff

5

When fiscal transparency is lacking and fiscal governance is poor, this can be referred to as fiscal irresponsibility in governance and can lead to fiscal anarchy. This is worse when it is mixed with impunity.

Nigeria has long been a victim.

The core of fiscal responsibility is the implementation of budget, both at the national and state levels. It is a critical component of the Public Financial Management (PFM) system and the phase that determines the actual volume of government expenditure and ensures that there is a close match between cost and quantity and quality of public services.

This has also become a critical issue in Nigeria’s governance system, as the citizens are left wondering where the huge yearly appropriations end up, due to lack of evidence-base implementation. In fact, suspicions are sometimes confirmed with fallouts among collaborators. The ongoing probe into the controversial “Arms Deal” is a vivid example of fiscal irresponsibility.

Recently, a Fiscal Responsibility Index (FRI) benchmark was unveiled, with government agencies headlining the negative notes. The index was scripted specifically to benchmark different MDAs. It looks at MDAs level of conformity to overall fiscal discipline hence excludes the general macroeconomic benchmarking variables and indicators that concern the overall financial health of the country or state such as fiscal deficit as a percentage of GDP, tax revenue as percentage of GDP and total outstanding liabilities as percentage of GDP.

In 2014, the Centre for Social Justice (CSJ), in collaboration with the Fiscal Responsibility Commission (FRC), with funding and technical support from the Open Society Initiative for West Africa (OSIWA) developed domestic instruments, indicators and index to facilitate benchmarking of the performance of federal MDAs in their implementation of fiscal laws and policies, including regulations on fiscal responsibility.

The index therefore, being the flagship assessment of how MDAs at the federal level have complied with the provisions of these laws, policies and regulations, was developed with inputs from different Civil Society (CS) groups, professional associations and government agencies, including the FRC before validation.

It covers sub-indexes on policy based budgeting; budget comprehensiveness and transparency; budget credibility; budget implementation, monitoring and evaluation; accounting, recording, reporting and external auditing; as well as a special section looking at how the Ministry of Finance delivers in some of the critical provisions of the Fiscal Responsibility Act (2007).

For a start the FRI pilot study comprised 16 federal MDAs over a period of 2011 to 2013 only- Federal Ministry of Agriculture and Rural Development; Aviation; Education; Environment; Health; Finance; Lands, Housing and Urban Development; Mines and Steel Development; Power; Transport; Trade and Investment; Science and Technology; Water Resources; Women Affairs; Works; and Youths Development.

The first part of the data was solicited information from the selected MDAs that are to be rated, while the second part was elicited information from credible government reports and other desk sources. The study also solicited published documents on fiscal procedures for the country to see how observed procedures across MDAs differ from the regulations.

The public, including the civil society groups and representatives of the various MDAs were notified in advance of the need to carry out this rating with the main goal of benchmarking Federal Government MDAs using the FRI in order to promote prudent public financial management across federal MDAs.

“The FRI therefore, supports the achievement of aggregate fiscal discipline, strategic allocation of funds, value for money, and probity in the use of public funds. This is justifiable because the need to impose financial discipline is at the core of Vision 20:2020 and the current administration Change Agenda. The FRI benchmark focuses on the operational performance of the PFM systems, and assesses it against critical objectives, which reflect the requirements of an open and orderly PFM system.

The benchmark is based on budget credibility; budget comprehensiveness and transparency; policy based budgeting; budget implementation, monitoring and evaluation; Accounting, recording, and reporting, as well as external auditing at every stage of the budget process. This is expected to help in ascertaining if MDAs have good systems in terms of PFM and a comprehensive and transparent budget process,” the Lead Director of CSJ, Eze Onyekpere, said.

Using the assigned aggregate score for each of the benchmarks, selected MDAs were visited with the instrument. Information sourced from the MDAs and others from government published materials were used in scoring every MDA with average computed in relation to 100 per cent. The scores ranged from 0 – 100 points, where 100 is the highest level of fiscal responsibility and zero (0) denotes the absence of fiscal responsibility (otherwise highest level of fiscal indiscipline or fiscal irresponsibility).

FRI thus, is expected to be a tool used by policy makers to boost progressive public financial management (PFM) that will not only look at inclusive policy based budgeting but foster comprehensiveness and transparency in budgeting and financial management (budget implementation, accounting, recording, reporting and auditing), as well as monitoring and evaluation that improves overall budget credibility.

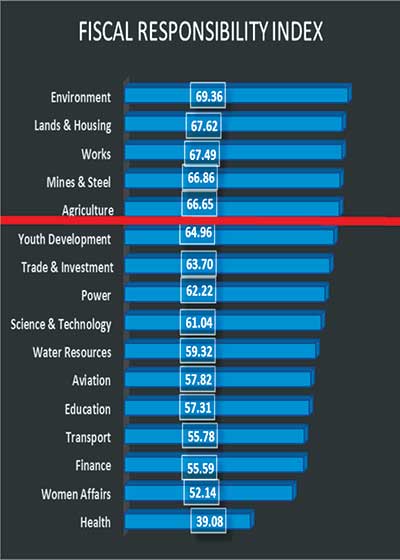

Fiscal-responsibility-indexAccording to the methodology adopted, the total of different sub-indexes were aggregated and the average calculated to arrive at the Fiscal Responsibility Index (FRI). Two-thirds (66 percent) is the minimum benchmark for an accepted level of fiscal responsibility in the MDAs.

However, evidence from the survey revealed that only ministries of Environment got 69.36 per cent; Lands and Housing, 67.62 per cent; Works, 67.49 per cent; Mines and Steel, 66.86 per cent; and Agriculture, 66.65 per cent, crossed the minimum benchmark for fiscal responsibility.

Other 11 MDAs in the study had scores below the two-third benchmark for a fiscally responsible establishment. While Environment has a score of 69.36 per cent to top the list, Health scores 39.08 per cent, as well as the least for all selected or pilot MDAs. The final scores of Fiscal Responsibility Index (FRI) showed that there were lots of works to be done at every MDAs, as none of them could make it to 70 per cent.

There is every need for improvement across the MDAs whether at the top or at the rear of the Index. This is important because sound fiscal policy and its attendant fiscal responsibility can have important long-run effects on the health of the Nigerian economy through its desired impact on growth of productivity, reduction of poverty and inequality and increased national saving,” Onyekpere added.

Policy-based budgeting

This involves a precise identification of public policy objectives, the delineation of the means and resources (time, money and manpower) for accomplishing them, as well as an accurate assessment of individual department’s accomplishments. It helps in improving comprehensiveness, as well as unifying the budget in terms of recurrent and capital investment, clarity to the budget and make budgeting procedure more predictable as well as help the reporting capacities to feed into a rolling cycle. When this happens the budget becomes more readable and makes it easier during analysis and documentation.

In Nigeria, the budget is expected to fall in line with the provisions of the Constitution, the Vision 20:2020 plan, the sectoral Medium Term Sector Strategies (MTSS), as well as other policy guiding the sector where the MDA is classified.

But the fiscal index for the period 2011 to 2013, showed that while all the 16 ministries under coverage applied the budgeting procedure, only the Federal Ministry of Works scored 92.5 per cent, with the Education counterpart scoring 50 per cent in its implementation. In fact, only six other ministries’ MDAs- Youth Development, Power, Agriculture, Environment, Mines and Steel, as well as Trade and Investment scored above the minimum threshold (two third or 66 percent) required of every MDA.

The result as presented, shows a weak link between budgets and policy in most of the selected MDAs. The issue of policy-based budgeting involves assessing its sustainability, including review of envelopes, costs and objectives, studying allocations and tradeoffs to enable gradual fiscal adjustment as well as favoring strong predictability which enables the monitoring of performance.

“MDAs as well as governments at all levels continue to face unknown financial and political pressures as they struggle to develop meaningful and fiscally prudent budgets. If policy drives budgeting, it will help the country to objectively determine how to match available resources with community priorities as well as meaningfully engage citizens in the budgeting process,” Donald Ikenna Ofoegbu of the Citizens Wealth Platform and Programme Officer at CSJ, said.

Budget comprehensiveness and transparency

While budget comprehensiveness has to do with orderly provision of public resources to public purposes and covering the field, budget transparency refers to the extent and ease with which citizens can access information on the budget and provide feedback to government on revenues, allocations, and expenditures. Comprehensive budgets are expected to increase accountability and transparency and enable policymakers’ and public scrutiny over the spending of public funds.

Both provide the required details in simple terms. Budget comprehensiveness and transparency, while not a goal in itself, is a prerequisite for public participation and accountability. A budget that is not comprehensive or transparent, accessible, and accurate cannot be properly analyzed by the citizens and hence may affect the monitoring of its implementation and thorough evaluation of its outcomes. Budget comprehensiveness and transparency has to do with the full disclosure of all relevant fiscal information in a timely and systematic manner and in recent times has come to be seen as a pillar of good governance.

Evidence from comprehensiveness and transparency index shows that apart from the Ministry of Environment in the survey period, the other 15 selected MDAs did not cross the benchmark score of two-thirds or 66 percent.

As a growing evidence base, open budget systems can enhance the credibility of policy choices, increase the effectiveness of policy interventions, limit corrupt and wasteful spending and facilitate access to international financial markets. The result of this index corroborates the latest result of the country in the 2015 Open Budget Index (OBI) where Nigeria scores 24 out of 100 points- a poor global show.

Budget credibility

Though budget credibility remains an important aspect of the budget, it has also become a difficult area to investigate, particularly because of the lack of detailed data availability. Overtime in Nigeria, plans or policies approved in the paper, bear little resemblance to the actual pattern of public financial activity that took place by the end of the budget period.

For example, the Fiscal Responsibility Commisssion (FRC) said a study of of the Federal Government budget over the period of 2004-2009, showed that on the capital expenditure side of major MDAs differ significantly from what is budgeted. On the average, the biggest gainers in implementation were Agriculture (budgeted 9.1 per cent, but actual 13.4 per cent); the Presidency (3.6 per cent budgeted, but actual 4.6 per cent); the Judiciary (two per cent budgeted, but actual 2.4 per cent); the National Assembly (one per cent budgeted, but actual 2.4 per cent); Niger Delta Development Commission (2.5 per cent budgeted, but actual 3.2 per cent); and the Federal capital Territory (seven per cent budgeted, but actual 7.7 per cent).

On the other hand, heavy losers have been Power and Steel (11.2 per cent budgeted, but actual is six per cent); Health (five per cent budgeted and actual 4.6 per cent); Transport (2.2 per cent budgeted, and actual 1.4 per cent); Science and Technology (1.5 per cent budgeted and actual 1.1 per cent); Internal Affairs (1.6 per cent budgeted and actual 1.1 per cent); and Federal Inland Revenue Service (0.9 per cent budgeted and actual 0.3 per cent).

If the budget is a law and during implementation, such deviations are recorded even in the face of shortfalls in the expected revenue, it implies that some priority projects in some other sectors can no longer be implemented and hence the credibility of the budget is in question. Indeed, budget credibility has become key concern in Public Finance Management in Nigeria.

The average Nigerian has an interest in public spending choices and to keep the citizen on board, each of the important constituencies must be at least minimally satisfied with the budget and its outcomes. Not executing budgets as planned raises two challenges. Firstly, it makes the development of accountable public institutions more difficult: If the budget is not credible, it undermines any form of ‘contract’ between those who provide funds (taxpayers and donors) and those entrusted to administer them in accordance with the agreed plan (government).

Secondly, if the budget is not credible, major functions (allocative efficiency, operational efficiency and fiscal discipline) will be compromised, as it can’t be used as a management tool for coordinating action to achieve government objectives. The FRI revealed that only one MDA (Aviation) has the score that is higher than the benchmark score, while 15 others wobbled.

Budget implementation, monitoring and evaluation

Budget implementation is a critical component of the Public Financial Management (PFM) system in Nigeria because it is the phase that determines the actual volume of government expenditure and ensures that there is a close match between cost and quantity and quality of public services- the impact on the welfare of the people and indeed the performance of the economy as a whole.

It requires and promotes fiscal discipline and reduces opportunities for corruption. Good budget execution also ensures that there is transparency, accountability, timeliness and credibility in government financial management.

Unfortunately, several challenges have beset effective budget implementation in Nigeria. These are insufficient funding, which is the outcome of inserting too many projects in the budget beyond the financial capacity of government; poor conceptualisation and design of technical projects; commencement of implementation of engineering projects with preliminary designs as against final designs and technical drawings; community issues relating to land acquisition; poor procurement planning and abuse of the procurement process; tardiness of some contractors and service providers, among others.

Still, evidence from the survey in terms of budget implementation, monitoring and evaluation showed that beside Agriculture, Lands and Housing and Youth Development MDAs, other selected MDAs failed the FRI.

These problems must be emphasised as a reflection of lack of incentives for good budget implementation, system wide and integrity challenges rather than lack of capacity. There is need for incentives for compliance or non-compliance to address institutional issues which are very crucial and not just the so-called “technical” fixes.

Accounting, recording, reporting and auditing

In Nigeria, transactions comprising of cash, cheque and/or transfers are recorded as complete in the books, hence allows a reconciliation from cash-based on “above-the-line” fiscal accounts with the financing of any deficit “below the line.” Some countries are currently moving towards accrual accounting, which is different from cash accounting.

In contrast to cash-based accounting, which only recognizes expenditure when it is paid and income when it is received, accrual-based accounting requires that expenditure and liabilities are accounted for when goods and services are delivered, even if payments have not been made; and revenue and receivables are recorded when goods are sold, even if proceeds have not been received.

The accounts may be held by MDA as was the case before the introduction of Treasury Single Account (TSA) by the new administration in 2015. The accounts are usually audited at a later stage. For the full transparency and accountability required for and demanded from sound budget implementation, there must be timely production and dissemination of adequate budget management information. This is also required by all stakeholders in the budget process.

For emphasis, public sector accounting in Nigeria include the process of recording, analysing, summarising, reporting, communicating, and interpreting of financial information in aggregate and in details, reflecting all transactions including the receipts, transfers and disbursement of government fund and property.

Evidence from the FRI report showed that most MDAs including Science and Technology, Mines and Steel, Water Resources, Finance, Aviation, Environment, Lands and Housing, Education as well as Agriculture have scores above the index benchmark (80 percent). However, other MDAs have scores below the index’s minimum benchmark. The failure is a clear violation of basic requirements that within the budget period, revenue and expenditure are properly organised, recorded and reported to internal and external audit institutions in conformity with the realization concept. It is also important that all the expenses incurred in earning revenue must be matched with the revenue of the period.

Fiscal Responsibility Act (2007) provides that the Minister of Finance shall be responsible for the preparation of the Medium-Term Expenditure Framework (MTEF). With the new structure of the Federal Executive Council, it seems this responsibility is now tilting towards the Ministry of Budget and National Planning. The FRA also assigns other duties to the Ministry in section 1-14.

As part of the assessment of how these assigned duties are performed, a set of indicators were identified: Analysing if the budget framework for the period contains the necessary fiscal policy and resource revenue components; if the budget framework contain information on Fiscal Policy and Asset Management; if the Ministry accounts regularly for resource revenue; the time the Ministry submits the MTEF to the National Assembly for consideration; the content of the macroeconomic framework in the MTEF; the content of the fiscal strategy component of the MTEF; if the fiscal strategy paper contains an expenditure and revenue framework; evidence that the Ministry during the preparation of the MTEF sought inputs from the relevant agencies and bodies; evidence that the Minister of Finance during the preparation of the MTEF held public consultation on the Macro-economic Framework, the Fiscal Strategy Paper, the Revenue and Expenditure Framework, the strategic, economic, social and developmental priorities of government, among others.

The FRI report showed that of all these provisions, the Finance Ministry was able to perform two out of the 10 roles to a maximum point. The other roles were either half done or not done in line with the provisions within the study period. This implies that other provisions of the FRA (2007) were not carried out to the letter. Top of the provisions neglected include the budget framework not containing full information on Fiscal Policy and Asset Management as well as lack of evidence to show that the Minister of Finance during the preparation of the MTEF held public consultations.

The “change” administration offers the country another opportunity to rewrite its negative indices from various economic fronts. Fortunately, it made the promises during election campaigns and reiterated it after winning the election. Perhaps, it would be apt to say that previous administrations, to this point, made the same promise. The time is now. The “economy” is waiting for signal and Nigerians are ready to feel its reality as a testimony.

Fiscal responsibility should be improved across all MDAs in raising and spending public money on identified and approved national priorities. It should also be mainstreamed in monitoring and evaluation.

MDAs should place emphasis on how to manage the country’s resources, obligations and fiscal risks in a manner that ensures the sustainability of the fiscal position in the short, medium and long terms by adhering to the provisions of fiscal laws and policies both in theory and in practice. This is the only way the country can boost her productivity (output per capita) and standard of living;

Every MDA should study the detailed completed survey instruments with analysis and scoring template to understand where she needs to improve in terms of documentation and practice to ensure better service delivery and compliance to provisions of the Fiscal Responsibility Act as well as other fiscal related laws and policies of the Government of Nigeria.

For more http://www.ngrguardiannews.com/2016/01/rewriting-the-nations-poor-fiscal-responsibility-index/