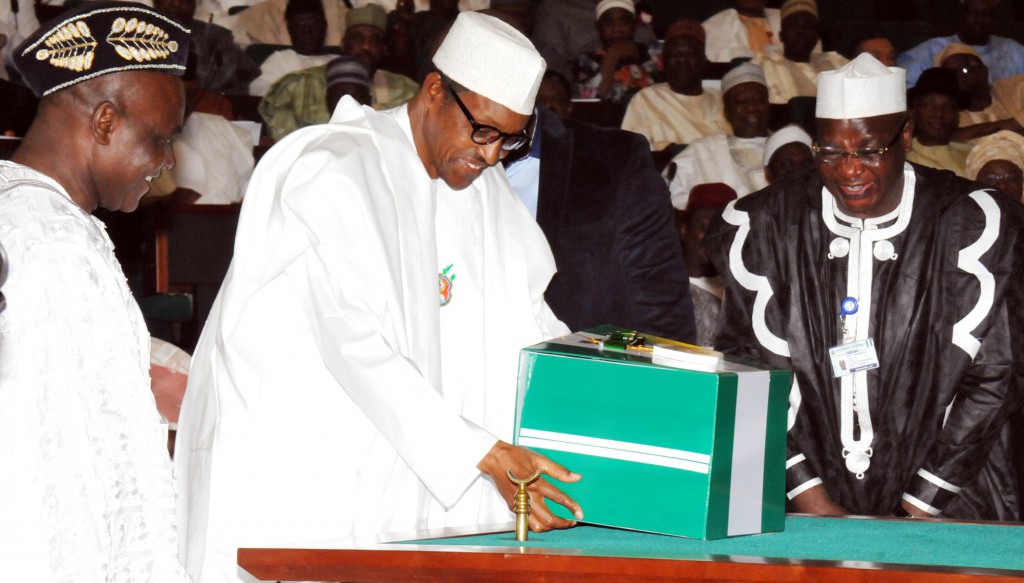

Interrogating The Fundamentals Of The 2016 Federal Budget.

-

July 18, 2016

- Posted by: Center for Social Justice

The recent briefing of the Senate by the Minister of Budget and National Planning, Udoma Udo Udoma, on the level of implementation of the 2016 federal budget calls for sober reflection. It provides an opportunity to draw lessons in budget preparation, especially revenue forecasting, fiscal risk mitigation and conditions precedent before revenue sources are used for expenditure projection.

A budget is not just mere revenue and expenditure projection as some analysis will have us believe. It is an Appropriation Act or law proposed in the form of bill by the executive, approved by the legislature and gets back to the table of the President for his assent. It is a law meant to be obeyed or implemented at the pain of punishment. The undergirding document is the Medium Term Expenditure Framework which includes a macroeconomic framework, fiscal strategy paper, a revenue and expenditure framework, consolidated debt statement and a statement describing the nature and fiscal significance of contingent liabilities and measures to be taken to offset their crystallization. The estimates of the budget are supposed to be prepared by experts using empirical data and analysis to come to reasonable conclusions. The Fiscal Responsibility Act in Section 11 states that the estimates are to be prepared with reliable and consistent data. Variations in revenue forecasts of –five per cent or + five per cent are acceptable and make sense given the limits of human error and the fallibility of mere mortals.

The forecasts should not be based on pious hopes and expectations without empirical basis or just to score a political point. Even if monies were to be borrowed, the sources of the loans should have been identified and the process of negotiations should have commenced before the budget is approved. This position is grounded on the medium term debt strategy which is proposed by the executive and approved by the legislature to guide debt procurement and debt related matters over a three year horizon. Also by Section 19 of the FRA, the budget bill sent to the legislature is to be accompanied by measures on cost control to reduce wasteful expenditure and a Fiscal Risk Appendix evaluating the fiscal and other related risks to the annual budget and specifying measures to be taken to offset the occurrence of such risks.

It is against this background that when the N6.06trillion budget was prepared and approved, discerning Nigerians thought the home work that precedes a good budget had been done, especially coming from a government premised on change which sought to do things differently. The government celebrated the sheer size of the budget as an achievement which the previous regime could not have done, especially the size of the capital vote which appeared to be the highest in the nation’s budgeting history. But such chest beating should have waited until after implementation because we had capital votes in excess of N1.5trillion before which did not attain more than 60 per cent implementation.

According to the Overview of the 2016 Budget and Strategic Implementation Plan prepared by the Ministry of Budget and Planning: “the Federal Government budgeted revenue is projected at N3.855 trillion largely contributed by its Internally Generated Revenue of N1.51 trillion, which is 35 per cent increase over the N2.855 trillion for 2015. The growth in the Federal Government’s revenue is mainly to be derived from the growth in non oil resources namely: Corporate Tax; VAT and dividend from government corporations and independent revenue. In this regard, we have projected corporate taxes of N1.88 trillion in 2016 from N1.42 trillion in 2015, and VAT collection of N1.48 trillion in 2016 from N1.28 trillion in the previous year.”

The first point to note from this projection is that the budget is a figure higher than previous years at a time of declining economy and attendant revenue. There is an inbuilt deficit of N2.21trillion. Emerging trends point to the fact that we are witnessing revenues lower than projected and may not know exactly where to get revenues to fund the deficit. According to media reports on the Senate’s meeting with the Minister of Budget and Planning, he is reported to have stated that the federal government was not achieving budgetary targets because of the drop in the country’s revenue, but added that 50 per cent has been achieved on personnel, 25 per cent on overhead costs and 15 per cent on capital projects. He said that no new project has been funded because of the procurement procedure and low revenue generation. This disclosure is coming by the seventh month of the year. It was not even a proactive disclosure done by the minister to inform Nigerians on the state of budget implementation but was forced out of a response to a Senate summon.

This state of a drop in revenue targets raises the poser; where is the

2016 Fiscal Risk Appendix that evaluates the fiscal and other related risks to the budget? What specific measures did it propose to offset the occurrence of low revenue or revenues not meeting targets? Or as usual, the fiscal authorities may have thought that such an Appendix is one of those unnecessary things provided in the FRA and for which they are not bound to obey. Considering the daily crude oil production of 2.2mbpd, was it a wise decision not to engage the Niger Delta militants early enough when they started disrupting oil production? Has the government sufficiently dialogued with the militants to avert further loss of revenue? Again, at a time the Central Bank of Nigeria had warned that the economy was headed for a recession, was it prudent to project more revenue from VAT and corporate tax? If corporate profits were headed south, where would the increment in taxes come from? If the disposable income available to Nigerians shrank, workers are not paid and companies laid off workers, how would this result to an increment in VAT collection?

In circumstances like this, the need for a Fiscal Risk Appendix re-echoes. Section 28 of the FRA states on power to restrict further commitments that (1) where by the end of three months, after the enactment of the Appropriation Act, the Minister determines that the targeted revenues may be insufficient to fund the heads of expenditure in the Appropriation Act, the Minister shall, within the next 30 days of such determination, take appropriate measures to restrict further commitments and financial operation according to the criteria set in the Fiscal Risk Appendix. Do we have an extant Fiscal Risk Appendix and what criteria did it set for the restriction of financial commitments in these hard times?

In conclusion, laws like the FRA are meant to be obeyed and when they are observed in the breach, there are bound to be repercussions on the economy and fiscal governance. The equilibrium will be upset. Mistakes have been made in the process of preparing the 2016 federal budget and now, this is manifesting in several implementation challenges. But we can learn lessons and use them to fine-tune the preparation and implementation of future budgets. The legislature is hereby called upon to fully familiarize itself with the provisions of the FRA so that it can help the executive to do the right things.

Follow me on twitter @censoj